michigan gas tax revenue

Tax revenue in FY 2010-11. But that was based on an expected average price per gallon at.

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

It is estimated that fuel efficiency gains alone would lead to a 1 billion per year shortfall in Michigan gas tax revenue by 2050.

. Producers or purchasers are required to report the oil and gas production and the. Currently state gas taxes range from 1432 cents per gallon in Alaska to 6205 cents per gallon in California not including the 184 cents per gallon federal gas tax they wrote. Motor fuel taxes are levied on.

History of Michigan Gas and Diesel Fuel Tax Rates Sources. In Michigan the revenue from regular gasoline sales tax was projected to be 621 million in the 2022 fiscal year. Michigan Terminal Control Numbers.

Weve included gasoline diesel aviation fuel and jet fuel tax rates for 2022. Although directed to the Michigan Transportation Fund revenue from the Michigan gasoline tax broke 1000 million for the fifth time in the last 12 months. In general mining operations and property in Michigan are subject to the same state and local taxes applicable to other commercial ventures.

Income Tax CIT combined with less-than-expected IIT refunds to account for the over-forecast. Notice of New Sales Tax Requirements for Out-of-State Sellers. 2015 PA 179 earmarked.

Fiscal Year Ending 1987 1989 1991 1993. Federal Excise Tax In addition to Michigans 19-cent. If you have any questions in.

Taxation and Revenue Structure. 0272 gallon. The owner of the motor fuel is required to fill out form number 4010 and remit any additional motor fuel tax that may be owed to the Department.

Combined business tax collections from the Single Business Tax Michigan Business Tax. 003 gallon. The Michigan Severance Tax Act MCL 205301 levies a tax on oil and gas severed from the soil in Michigan.

003 gallon. Streamlined Sales and Use Tax Project. How does the Michigan gas tax work.

The revenue Michigan received from its motor fuel tax MFT in fiscal year 2018 was 226 billion of which 259 percent or 5879 million was diverted to the. Bureau of Labor Statistics US. Michigan Fuel Product Codes - Effective October 2017.

0272 gallon. If a gallon of gas costs 320 you would be paying 184 cents federal tax plus the 263 cents state tax and an additional 17 cents in. Federal excise tax rates on various motor fuel products are as follows.

See current gas tax by state. For transactions occurring on and after October 1 2015 an out-of-state seller may be. Its important to future-proof Michigans.

If the share of EVs were to increase to half of all vehicles we estimate in our report that the Michigan gas tax shortfall would grow to 2 billion per year by 2050. 0183 per gallon. Service Interruption and Import Verification Numbers.

Revenue from the motor fuel taxes is dedicated by the 1963 Michigan Constitution for transportation.

Michigan Sales Tax Increase For Transportation Amendment Proposal 1 May 2015 Ballotpedia

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

Oregon Gas Tax Increase Asce S 2021 Infrastructure Report Card

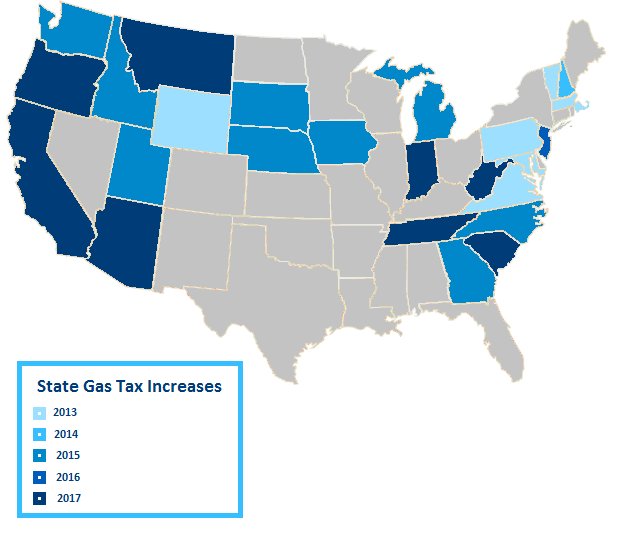

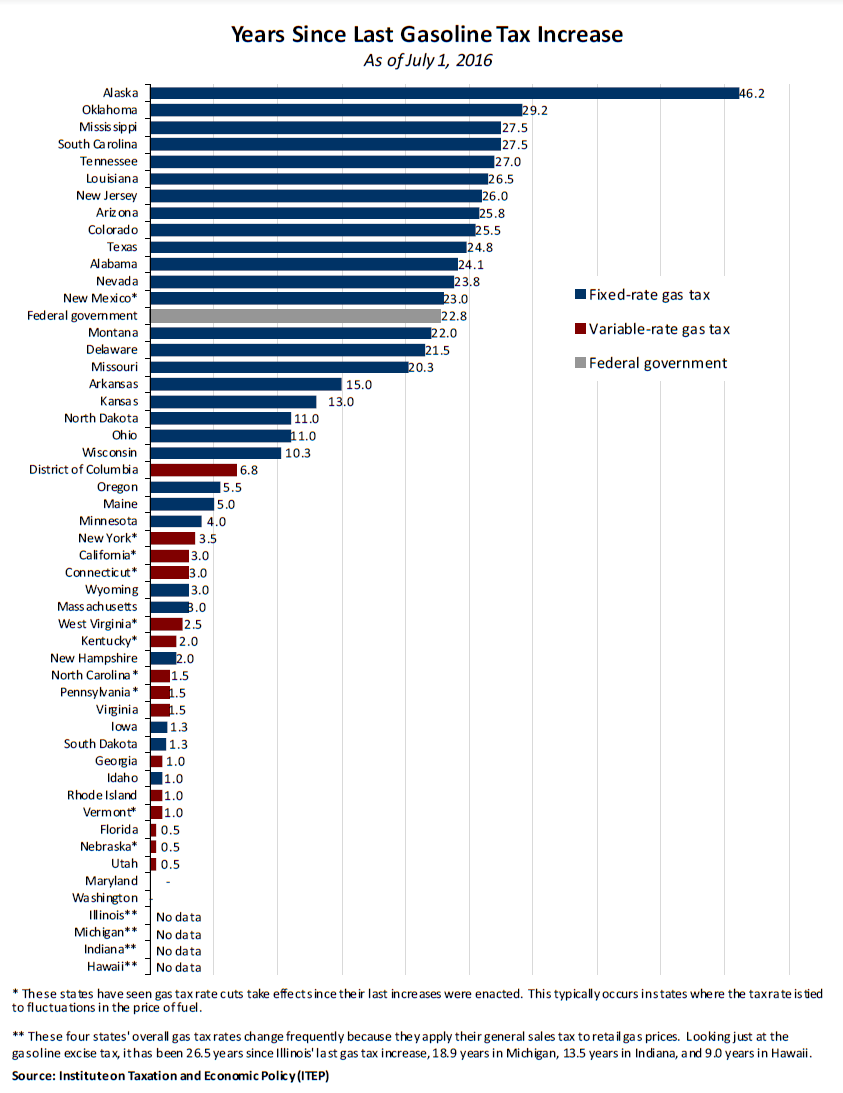

How Long Has It Been Since Your State Raised Its Gas Tax Itep

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Vehicle Miles Traveled Vmt Tax Highway Funding Tax Foundation

Michigan Will Collect More Taxes Without Gas Tax Increase

Gas Prices Are Near Record Highs Consumers Want Some Relief A Tax Holiday Npr

Gov Rick Snyder Signs 1 2b Road Funding Package

Historic Motor Fuel Tax Revenues Citizens Research Council Of Michigan

U S Energy Information Administration Eia Independent Statistics And Analysis

Recent Legislative Actions Likely To Change Gas Taxes

Michigan House Dem Leader Says Whitmer S 45 Cent Gas Tax Is Probably Dead Bridge Michigan

Most Americans Live In States With Variable Rate Gas Taxes Itep

Gas Tax Rates By State 2020 State Fuel Excise Taxes Tax Foundation

Michigan S May Tax Proposal Mackinac Center

Lawmakers Eye Pause In Michigan Gas Tax As Prices Soar But Which Tax Bridge Michigan

House Approves 6 Month Pause Of Michigan S 27 Cent Per Gallon Gas Tax